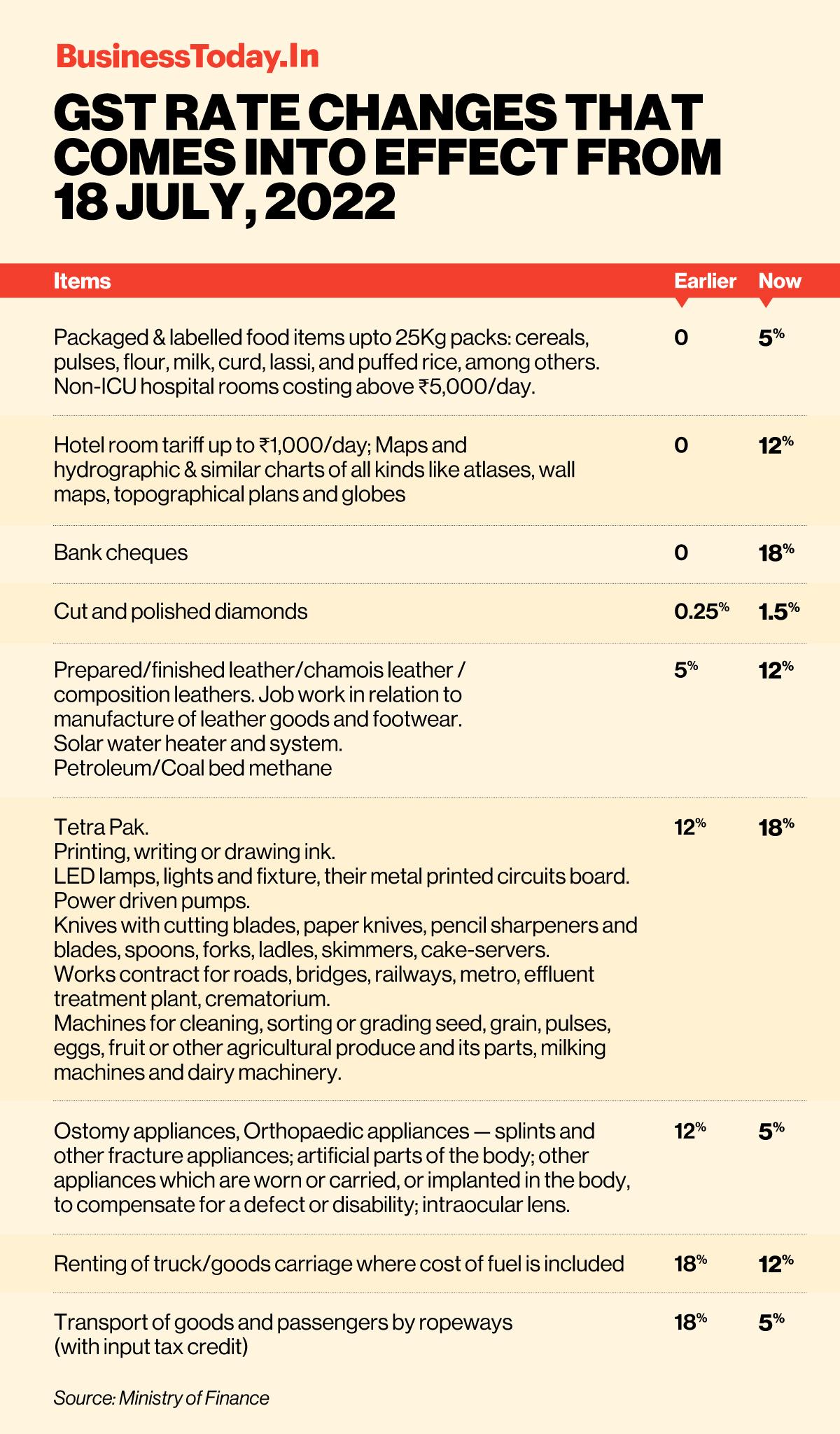

List of new GST rates: Products and services that have become more expensive

The revised Goods and Services Tax (GST) rates have come into effect from today, July 18.

New GST Rate: From next week, several household items including hotels and bank services among other things, will get costlier after the GST rates were hiked for several items in the 47th Goods and Services Tax meeting in Chandigarh last month. The GST rate hike on these items will be implemented from Monday, July 18, after which the common man will have to pay extra to buy day to day items, further increasing their kitchen budget. Products like curd, lassi, buttermilk, paneer, wheat, rice etc which are pre-packaged and labelled, will attract a GST of 5% from 18 July.

In any agri and dairy products, if sold loose or packed in front of the customers, will continue to be exempt from GST. Earlier, only branded packaged rice was under the purview of GST. Now, all unbranded, pre-packaged rice/ rice flour/ wheat flour will attract GST.

The new Goods and Services Tax (GST) rates, which were revised during the two-day GST council’s 47th meet held last month in Chandigarh, came into effect from Monday.

Now, packed foods like flour, milk, curd and paneer and unpacked ones, including rice and wheat, when packed, will be brought under the 5% slab. While solar water heaters, leather products and hotels charging Rs 1,000 or less per day for stay will come under the 12 per cent slab.

HIGHLIGHTS

- Packed foods like milk, curd and paneer get costlier

- GST on hotels charging Rs 1,000 or less per day for stay has increased

- Renting of truck, goods carriage where the cost of fuel is included is cheaper now